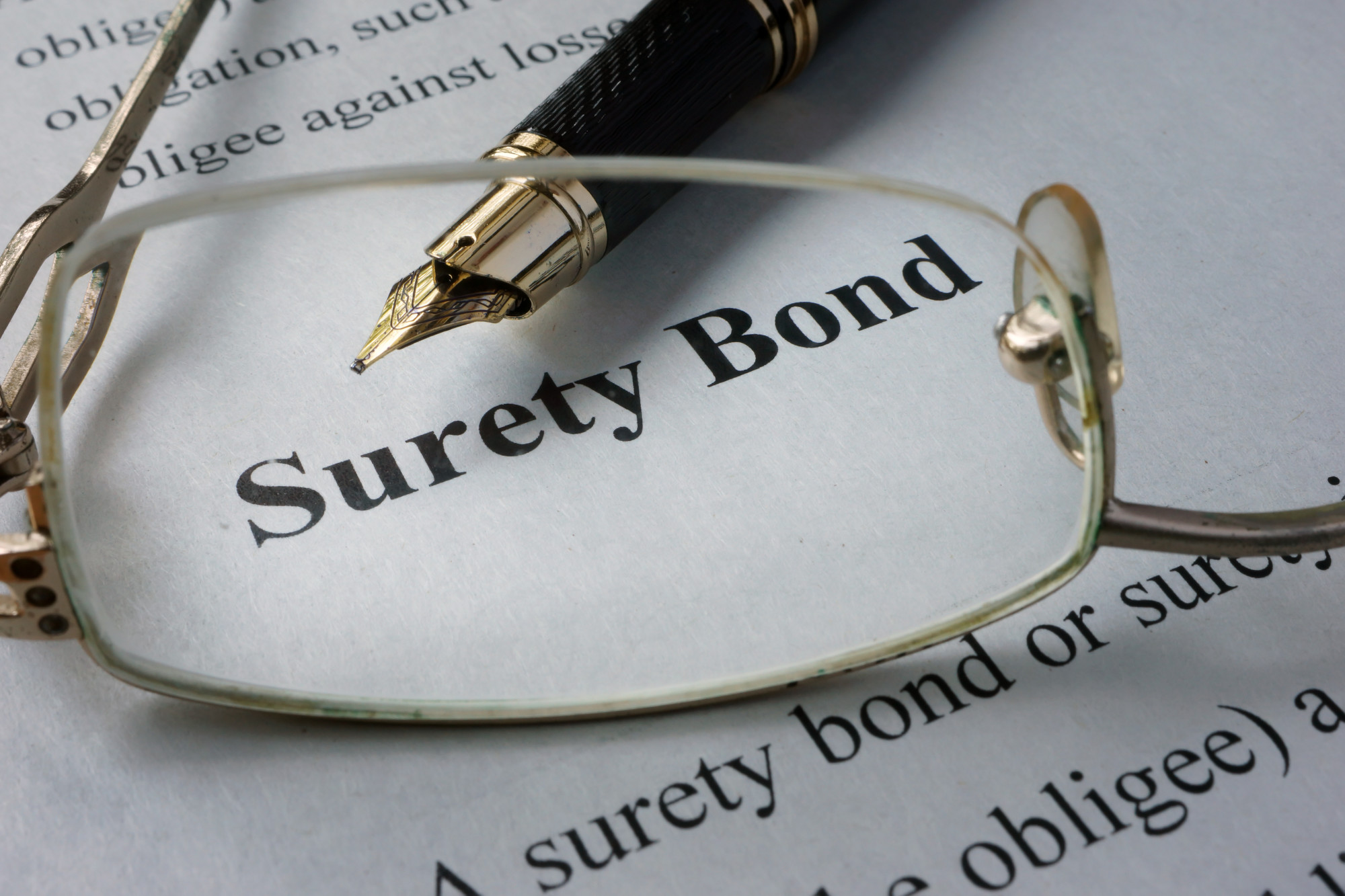

How Surety Bonds Work

7Newswire

25 Jan 2023, 19:35 GMT+10

You are a contractor, freelancer, or the like. You get brought on to a project, and the client promises to pay you after the job is done. You hope it is true, but what happens if payment never comes?

The client is gone, and you are left with unpaid invoices. What do you do about it? How can you protect yourself and your company? Run to the bank, get an E&O insurance policy, and then make the cashier get you a surety bond.

Yes, surety bonds are that valuable. Check out this guide to learn about surety bonds and how they work.

How Do Surety Bonds Work?

Surety bonds are contracts between the obligee, the principal, and the surety.

The obligee, or beneficiary, is the party the Surety Bond protects. The principal is the individual or entity performing the service being bonded for. The surety, or bond provider, is the company that protects the obligee in the event of a breach of contract. The surety provides a bond to protect the obligee against financial losses if the principal fails to fulfill the agreed-upon terms of the agreement.

The surety pays a fee to the principal to guarantee the principal's contract performance. In exchange, the bond provider has the right to take legal action to recover any losses that result from the principal's breach of contract.

What Are Several Types of Surety Bonds?

There are many types of surety bonds available:

Contract Bonds

Contract bonds are a type of surety bond that guarantees contractual performance by one party to another. The bond is meant to protect the obligee, or person that the work is being done, from commercial risk or financial loss if the bonded contractor does not fulfill the contract's obligations.

License and Permit Bonds

Government agencies require these to ensure that businesses comply with regulations. They are required for businesses in certain industries, such as auto dealers, collection agencies, and mortgage brokers.

Court Bonds

These are required by courts to guarantee that a party will fulfill its legal obligations. They include appeal bonds, fiduciary bonds, and probate bonds. Appeal bonds are required when a party appeals a court decision, fiduciary bonds are required when a person is appointed to manage the assets of another person, and probate bonds are required when a person is appointed as the executor of a will.

When to Use a Surety Bond?

When you are looking to guarantee the performance of an activity to someone else, then you need to be sure that you need a surety bond. For example, if you are a business owner and you have to make sure that you are going to complete a project, then you could get a surety bond.

This bond is a form of insurance that guarantees they will do the work. It is similar to having a contract backed up by an insurance company that will cover any losses incurred due to failure of project completion. If you want to know where to buy surety bonds, you could surely buy surety bond online!

Ensure the Business Will Complete Their Job

Surety bonds are a great way for businesses to ensure trust and responsibility when working. They guarantee that businesses will remain compliant and seek out any incorrect actions.

Businesses that want to guarantee these protections should be sure to obtain the right surety bond. Get started today to ensure the trust and responsibility of your business!

We hope this article was useful to you. If you enjoyed it, be sure to check out our blog for more great articles. Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hawaii Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hawaii Telegraph.

More InformationInternational

SectionGaza War sucking life out of an Israeli generation

In the past month alone, 23 Israeli soldiers have been killed in Gaza—three more than the number of remaining living hostages held...

Faulty IT system at heart of UK Post Office scandal, says report

LONDON, U.K.: At least 13 people are believed to have taken their own lives as a result of the U.K.'s Post Office scandal, in which...

Travelers can now keep shoes on at TSA checkpoints

WASHINGTON, D.C.: Travelers at U.S. airports will no longer need to remove their shoes during security screenings, Department of Homeland...

Rubio impersonator used AI to reach officials via Signal: cable

WASHINGTON, D.C.: An elaborate impersonation scheme involving artificial intelligence targeted senior U.S. and foreign officials in...

Warsaw responds to migration pressure with new border controls

SLUBICE, Poland: Poland reinstated border controls with Germany and Lithuania on July 7, following Germany's earlier reintroduction...

Deadly July 4 flash floods renew alarm over NWS staffing shortages

WASHINGTON, D.C.: After months of warnings from former federal officials and weather experts, the deadly flash floods that struck the...

Business

SectionMusk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...

Ex-UK PM Sunak takes advisory role at Goldman Sachs

NEW YORK CITY, New York: Former British prime minister Rishi Sunak will return to Goldman Sachs in an advisory role, the Wall Street...

Gold ETF inflows hit 5-year high as tariffs drive safe-haven bets

LONDON, U.K.: Physically backed gold exchange-traded funds recorded their most significant semi-annual inflow since the first half...

PwC: Copper shortages may disrupt 32 percent of chip output by 2035

AMSTERDAM, Netherlands: Some 32 percent of global semiconductor production could face climate change-related copper supply disruptions...

U.S. stocks recover after Trump-tariffs-induced slump

NEW YORK, New York - U.S. stocks rebounded Tuesday with all the major indices gaining ground. Markets in the UK, Europe and Canada...

Stocks slide as Trump unveils 25% tariffs on Japan, S. Korea

NEW YORK CITY, New York: Financial markets kicked off the week on a cautious note as President Donald Trump rolled out a fresh round...