SHAREHOLDER REMINDER: Berger Montague Advises Investors Of A Securities Fraud Action Filed Against POLISHED.COM INC. (NYSE: POL) f/k/a 1847 Goedeker Inc. (NYSE:GOED); Lead Plaintiff Deadline is December 30, 2022

ACCESS Newswire

22 Nov 2022, 21:13 GMT+10

PHILADELPHIA, PA / ACCESSWIRE / November 22, 2022 / Berger Montague advises investors that a securities fraud class action lawsuit has been filed against Polished.com Inc. ('Polished') (NYSE:POL), f/k/a 1847 Goedeker Inc. ('Goedeker') (NYSE: GOED) on behalf of those who purchased securities: (1) pursuant and/or traceable to the registration statement and related prospectus (collectively, the 'Registration Statement') issued in connection with Polished's 2020 initial public offering (the 'IPO' or 'Offering'); and/or (2) between July 27, 2020 and August 25, 2022, inclusive (the 'Class Period').

Investor Deadline: Investors who purchased or acquired Polished and/or Goedeker securities during the Class Period may, no later than December 30, 2022, seek to be appointed as a lead plaintiff representative of the class. For additional information or to learn how to participate in this litigation, please contact Berger Montague: James Maro at [email protected] or (215) 875-3093, or Andrew Abramowitz at [email protected] or (215) 875-3015 or visit: https://investigations.bergermontague.com/polished-inc/

According to the complaint, on August 3, 2020, Polished filed with the SEC the final prospectus for the IPO on a Form 424B4, which forms part of the IPO Registration Statement. In the IPO, Polished sold 1,111,200 shares at $9.00 per share.

On August 15, 2022, after market hours, Polished notified investors that it would not timely file its 'quarterly report on Form 10-Q for the period ended June 30, 2022 (‘Second Quarter 10-Q') within the prescribed time period' because Polished required additional time to complete a newly announced investigation.

Following this news, Polished's stock price fell 35% to close at $0.97 per share on August 16, 2022.

Then, on August 25, 2022, after market hours, Polished issued a press release entitled 'Polished.com Provides Corporate Updates; Engages Leading Strategic Consulting Firm and Receives New York Stock Exchange Notice Regarding Late Form 10-Q Filing' which announced that Polished had engaged 'a leading strategic consulting firm with retail and ecommerce operations expertise to augment its existing management, identify opportunities to accelerate long-term profitable growth and, separately, to potentially expedite the Audit Committee of the Board of Directors' ongoing investigation.'

Following this news, Polished's stock price fell 7% to close at $0.74 per share on August 26, 2022, further damaging investors.

The complaint alleges that, in the Registration Statement and throughout the Class Period, the defendants made false and/or misleading statements and/or failed to disclose inter alia that: (1) Polished's internal controls were inadequate; (2) Polished downplayed and obfuscated its internal controls issues; (3) Polished did not properly construct or remediate its inadequate and ineffective internal controls; (4) contrary to Polished's statements, the company was not remediating its internal controls; (5) as a result, Polished would engage in an independent investigation; (6) as a result of the investigation, Polished would, among other things, retain independent counsel and consultants, and delay its quarterly filings in violation of NYSE requirements of listing; (7) following the commencement of the investigation, Polished's CEO and CFO would leave the company; and (8) as a result, the defendants' public statements were materially false and/or misleading at all relevant times.

A lead plaintiff is a representative party that acts on behalf of other class members in directing the litigation. In order to be appointed lead plaintiff, the Court must determine that the class member's claim is typical of the claims of other class members, and that the class member will adequately represent the class. Your ability to share in any recovery is not, however, affected by the decision whether or not to serve as a lead plaintiff. Any member of the purported class may move the Court to serve as a lead plaintiff through counsel of his/her choice, or may choose to do nothing and remain an inactive class member.

Berger Montague, with offices in Philadelphia, Minneapolis, Washington, D.C., and San Diego, has been a pioneer in securities class action litigation since its founding in 1970. Berger Montague has represented individual and institutional investors for over five decades and serves as lead counsel in courts throughout the United States.

Contacts:

James Maro, Senior Counsel

Berger Montague

(215) 875-3093

[email protected]

Andrew Abramowitz, Senior Counsel

Berger Montague

(215) 875-3015

[email protected]

SOURCE: Berger Montague

View source version on accesswire.com:

https://www.accesswire.com/727757/SHAREHOLDER-REMINDER-Berger-Montague-Advises-Investors-Of-A-Securities-Fraud-Action-Filed-Against-POLISHEDCOM-INC-NYSE-POL-fka-1847-Goedeker-Inc-NYSEGOED-Lead-Plaintiff-Deadline-is-December-30-2022

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Hawaii Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Hawaii Telegraph.

More InformationInternational

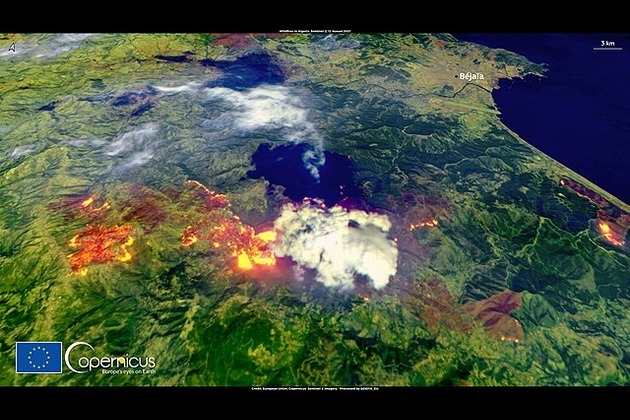

SectionTurkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Venetians protest Bezos wedding with march through the town

VENICE, Italy: Over the weekend, hundreds of protesters marched through the narrow streets of Venice to voice their opposition to billionaire...

New French law targets smoking near schools, public spaces

PARIS, France: France is taking stronger steps to reduce smoking. A new health rule announced on Saturday will soon ban smoking in...

Trump hints at DOGE investigation of Musk subsidies

WASHINGTON, DC - U.S. President Donald Trump on Tuesday claimed Elon Musk's success has been built on government subsidies. Without...

Native leaders, activists oppose detention site on Florida wetlands

EVERGLADES, Florida: Over the weekend, a diverse coalition of environmental activists, Native American leaders, and residents gathered...

Beijing crowds cheer AI-powered robots over real soccer players

BEIJING, China: China's national soccer team may struggle to stir excitement, but its humanoid robots are drawing cheers — and not...

Business

SectionWall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...

Taliban seeks tourism revival despite safety, rights concerns

KABUL, Afghanistan: Afghanistan, long associated with war and instability, is quietly trying to rebrand itself as a destination for...

Nvidia execs sell $1 billion in stock as AI boom drives record prices

SANTA CLARA, California: Executives at Nvidia have quietly been cashing in on the AI frenzy. According to a report by the Financial...

Tech stocks slide, industrials surge on Wall Street

NEW YORK, New York - Global stock indices closed with divergent performances on Tuesday, as investors weighed corporate earnings, central...

Canada-US trade talks resume after Carney rescinds tech tax

TORONTO, Canada: Canadian Prime Minister Mark Carney announced late on June 29 that trade negotiations with the U.S. have recommenced...